These days, making hard decisions quickly—and then executing efficiently—is the surest way to competitive advantage. Adaptability and resilience are the name of the game when it comes to global manufacturing and supply chain management. From natural disasters to trade wars to digital transformation, the winds of change are strong and blowing in sideways from every direction. GM is in the thick of one of these pivotal moments, and while tough calls like closing plants and laying off thousands of workers aren’t popular, even the biggest manufacturers in the world have to prepare for deep disruption.

The 90-day trade war ceasefire announced by the US and China after an international economic summit in Argentina might bring some temporary relief, but overall manufacturers (not to mention farmers and retailers) face similar challenges as automakers to deal with the fall of the combustion engine’s empire, and the rise of electric and autonomous vehicles, ridesharing models, and more.

In light of tariffs, skills shortages, and variable energy, labor and logistics costs, manufacturers increasingly need to produce goods closer to their customers. And as everyone except for political pundits seems to understand, the calculations are complex and go well beyond the decision to reshore production or continue outsourcing to China. As the consumer class rises in other countries, manufacturers must be ready to adapt their sourcing practices and supply chains if they want to grow. That’s why implementing technology frameworks and platforms that boost speed and agility will be a primary focus for manufacturers and their supply chains in the year ahead.

Manufacturing is on the move in 2019

In response to disruptive forces and in preparation for future business models and markets, smart manufacturers are getting ready to shift production, and learning to do it more frequently and efficiently. This means finding new sources of supply, qualifying them, and building out new or revamped supply chains. This is an effort of massive scale and complexity. Enterprises have to carefully assess if they have the resources—finances, technology, and skilled labor—to set up and optimize supply chains in new areas where they want to build capacity.

To open, close, and relocate plants, an organization has to develop powerful mechanisms for leverage, visibility, and control. The activity required to qualify new suppliers is a heavy lift in and of itself. The disruption of established manufacturing strategies has pushed procurement to the forefront of digital transformation, for it is only by incorporating comprehensive, integrated, and intelligent procurement systems that supply chains can become more agile.

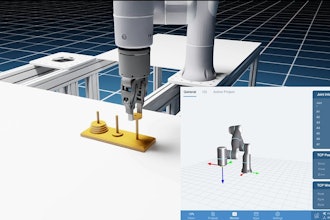

As the convergence of emerging technologies—cloud, big data analytics, IoT, 3D printing, robotics, process automation, and machine learning—continues to pick up pace, monumental challenges and opportunities will take shape. Manufacturers still relying on spreadsheets and emails to source direct materials, assess suppliers, or analyze performance won’t be able to keep up, and won’t be ready to move with the markets. Large global manufacturers are out in front rewriting the rules of engagement. Other enterprises and supply partners shouldn’t wait any longer to step up their procurement game.

No more compromising between speed and cost

For any size or type of manufacturer to stay competitive, they have to boost their speed and agility across the enterprise. Given the current state of procurement technology and analytics, there’s no longer any reason to compromise profit margins in the name of speed to market. Often, manufacturers will sacrifice their target costs in order to beat competitors to market. Or, product launches will be six months late due to efforts to optimize production costs. With a comprehensive digital procurement system, you can achieve both targets. As companies realize they have access to better tools in their pursuit of competitive advantage, new approaches are materializing.

In the recent past, many manufacturers would use digital procurement solutions to manage indirect costs like gloves, grease, and office supplies but would manage direct materials—by far the bulk of their spending—through spreadsheets! Yet it is direct materials that have the greatest impact on the cost and quality of a product, as well as the customer’s ultimate experience with it. In 2019, companies that aren’t managing indirect and direct costs on an integrated, holistic platform are leaving money on the table; they won’t be able to keep margins intact or drive efficiency improvements. In order to maintain speed, agility, and balance, they must be able to get the right information in front of the right decision-makers at the right time.

Optimizing procurement creates shock absorbers and reduces risk.

Manufacturers have to guarantee quality, safety and compliance to protect their customers, brand reputation and critical partnerships. Increasing visibility and control throughout the value chain makes it possible to detect risks before they turn into losses or advantage killers.

Cultivating the capability to “spin up” a supply chain in a new location with maximum efficiency and reliability is the best way to remain resilient in the face of the most serious global challenges—natural disasters, climate change, geopolitical unrest, resource scarcity, and economic uncertainty.

As we look ahead into a brand new year, it’s important to remember that the digital transformation of procurement isn’t all about staving off calamity. It’s also about getting the most out of of digital innovation and investment, solving the enterprise’s most pressing supply challenges, and shaping the future according to our most promising visions.

Greg Anderson is Vice President of Ivalua.