Nick Castellina

Nick CastellinaIn efforts to build customer loyalty, more manufacturers are expanding their footprint by selling Directly to Consumers (DTC) and taking on roles that were once reserved for distributors and retailers. For example, selling subscription services for packaged goods, such as razors and inviting customers to design fashion items with their phones, is now both prevalent and normal. Even Business-to-Business (B2B) manufacturers are jumping on board, stressing customer-centricity and offering products-as-a-service contracts. But, how do manufacturers make these new go-to-market models sustainable and profitable?

Software technology plays a major role in making this shift to direct-to-consumer commerce practical and financially realistic. Without the proper IT infrastructure and functionality, manufacturers may be taking on a challenge that is high-cost and high-risk. Here are the ways software can help manufacturers transition to a new commerce model.

How Did We Get Here?

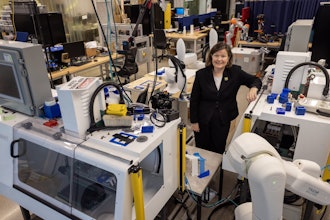

Operational Innovation. For decades, mass production had ruled the driving force behind modern efficiency and profitability. Operational innovations, like assemble-on-demand, hub-and-spoke modules, and easy-to-program robotics for fast change-overs, turned old-school manufacturing upside down.

E-commerce. E-commerce is making significant gains over traditional brick and mortar stores. Consumers spend $517.36 billion online with U.S. merchants, which is an increase of 15 percent over the previous year, according to U.S. Commerce Department figures. Traditional retailers are pushing into online retail to take advantage of the trend, too, with even grocery stores offering online ordering, pick-up and delivery programs.

Consumer Convenience. Consumers today seek convenience—and companies are responding. For example, Proctor & Gamble launched a subscription service for its Tide brand that allows consumers to get regular deliveries of Tide Pods laundry detergent.

Consumer Intimacy. Customers, especially millennials and those in Generation Z, have high expectations around sustainability, and they support companies that strive to reduce their carbon footprint. Today’s generation of consumers is fiercely loyal to causes and brands that share their beliefs.

Smart Products. Almost half of internet-wired households have some sort of smart home device, with thermostats, smart home systems, and smart appliances topping the list. The global smart home market is predicted to be worth $97.61 billion by 2025 according to a PwC survey.

Mobile Technology. Increasingly, consumers are using their phones to make purchases. Recently, Nike opted to focus on serving athletes on a one-to-one basis, using their Nike+ app. Nike says it plans to grow this part of its business by 250 percent in the next five years.

Social Media. The shifts in e-commerce are closely tied to the ubiquitous nature of social media. Consumers can praise or lambast a spokesperson and enterprise on social media, influencing perceptions and sales. Many manufacturers have learned that social media cannot be ignored or dismissed, so embracing its high potential is the more pragmatic approach.

B2B. Customer centricity means collaboration on product design or innovative process solutions and sharing of data and supply chain visibility, supported by networked connectivity. In the high-stakes B2B space, the customer is particularly demanding, waving big contracts as the incentive and insisting on indisputable quality and compliance.

Digitally Native. Some digitally native companies are bypassing all other forms of commerce. For example, Warby Parker began its #Warbyhometryon marketing campaign, encouraging customers to promote something they were already doing—taking photos and videos of themselves trying on eyeglasses.

Is it Working?

Research shows that almost half (48 percent) of manufacturers either have or plan to have DTC channels, with almost all of them (87 percent) seeing these channels as relevant to their products and consumers. However, the DTC landscape does have some pitfalls. Consumers frustrated with slow or complex purchasing screens will abandon their purchase. It is estimated that $4.6 trillion in e-commerce sales are lost to cart abandonment each year.

How can Manufacturers Optimize these Trends?

For many manufacturers, this is far from the traditional mass production methods that are entrenched in their history. Fully understanding the risks and obstacles before testing a concept is advisable.

Relationships. Heightened customer expectations also bring new opportunities—if the enterprise is willing to fully commit and go all-in with necessary resources of talent, time and software technology. Manufacturers that excel at building relationships and connected networks will be able to stand apart from the laggards who are slow to adopt innovative functionality. Customer Relationship Management (CRM) solutions can be valuable in managing the full customer lifecycle.

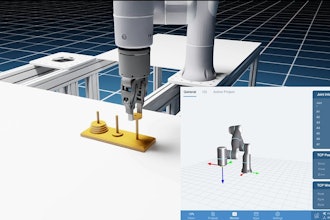

Configuration. A solution to help manage product configuration is one of the most important ways software technology helps manufacturers step up to the challenges of building a customer-centric approach. This is a huge time-saver for the sales team and engineering team, freeing them from manually redoing specs and quotes for each custom order.

E-commerce. Modern solutions also help manufacturers launch e-commerce programs. While there may be many off-the-shelf “shopping cart” programs, a manufacturer needs an e-commerce solution that can integrate with an Enterprise Resource Planning (ERP) solution, synchronizing with order entry, inventory, and back-end financials.

Innovation. Filling a spot closer to the consumer brings some advantages, including more immediate input for innovation and product development. Online shopping carts, interactive portals, and active social media listening, give manufacturers first-hand exposure to buyer feedback. This can shorten the product development stages and inspire fresh thinking for new designs.

Product Lifecycle Management (PLM). Manufacturers can optimize the development of new products with PLM solutions that help track objectives, milestones and communication at each stage of the product’s lifecycle, from cradle to grave.

3-D Printing. For highly customized products, advanced manufacturers can turn to 3D printing for components, decorative items or, accessories. The fashion industry is even incorporating 3D printing for personalized adornments, monogrammed features, and signature elements.

Supporting Processes. Manufacturers have traditionally turned to distributors and retailers to be the “front person”—engaging with customers in local and regional settings, maintaining inventory, acting as trusted advisors and offering one-on-one buying experiences. Bypassing these layers means manufacturers must step in and play that part. Making the shift to selling directly to consumers often requires a full enterprise shift, including new operational processes and departments.

Concluding Thoughts

For manufacturers that are already stretched thin, adding DTC capabilities may strain resources further. But, for the manufacturer that is willing to invest in software technology and commit to a new business model, marketing directly to the consumer has many benefits, particularly increased customer intimacy and brand loyalty.

Nick Castellina is director of industry and product strategy for manufacturing at Infor.