Running as lean and fast as they can to capitalize on every growth opportunity in 2018, manufacturers are taking bold steps to digitally transform operations in 2019. According to a recent survey of 151 North American manufacturers conducted by Decision Analyst on behalf of IQMS, technologies that bring greater insights and mobility are at the top of the list for enabling their transformation. These include real-time monitoring, analytics, business intelligence (BI), mobile enterprise resource planning (ERP), and quality management applications. Notably, the manufacturers that already are orchestrating these technologies in response to long-standing challenges, are growing at least 10 percent faster than their peers.

Manufacturers participating in the survey shared, not only about what they’re doing today, but also their plans for the coming year. These priorities were also reflected in interviews conducted at manufacturers’ facilities in the last few months. Based on combined observations from these companies, following are ten manufacturing technology predictions for 2019.

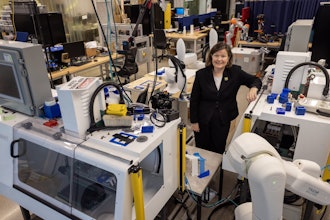

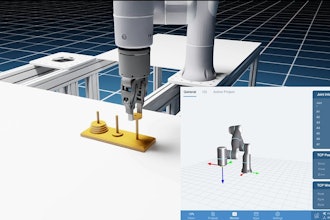

1. The era of smart machines is here, and it will make 2019 a pivotal year in enabling manufacturers to attain lights-on production. Industrial equipment manufacturers are fighting price wars with undifferentiated products today, often undercut on deals by offshore machinery providers. To survive, these manufacturing firms are aggressively pursuing a more intensive software-centric product development approach. The result is more affordable industrial machinery capable of running unattended for two or more production shifts. That’s going to make it possible for small and mid-tier manufacturers to attain lights-out manufacturing for the first time.

2. Real-time monitoring adoption accelerates beyond light sticks to Wi-Fi enabled shop floor networks and Internet of Things (IoT) enabled smart machines. In 2019, the clear business case for real-time monitoring across every manufacturing segment will drive widespread adoption. Among manufacturers surveyed, 81 percent reported that real-time monitoring is improving their business. And 52 percent of all manufacturers are relying on real-time monitoring to improve scheduling accuracy. All survey participants are gaining multiple benefits from real-time monitoring including better inventory control (48 percent), improved production plan performance (40 percent), and greater flexibility in managing production lines. Figure 1 summarizes insights on real-time monitoring use gained from the study.

3. More manufacturers will rely on analytics and BI to capitalize on data streams captured through real-time monitoring in improving production and capacity planning. As noted in Figure 2, 73 percent of manufacturers surveyed now consider analytics and BI applications essential for increasing production capacity through better resource planning. And manufacturers growing 10 percent or more per year are integrating their analytics and BI with mobile ERP and quality to gain more accurate financial visibility into shop floor production. These firms are looking beyond embedded offerings to a full-featured analytics footprint that can scale as their business grows. Collectively, these factors will drive greater adoption of analytics and BI in 2019.

4. The pervasiveness of mobile ERP and quality management apps deployments across manufacturing sites will accelerate in 2019, strengthened by advances in integration, usability, and higher-speed cellular network growth. Manufacturers see mobile ERP access as an enabling technology that provides greater data accuracy, improves operational efficiencies, and reduces production delays. (See Figure 3.) In a series of conversations, automotive, industrial equipment, and plastics manufacturers, observed that mobile ERP applications also are enabling them to better manage product configuration lifecycles. Having mobile apps that reflect the current state of customized product configurations across product lifecycle management (PLM), ERP, manufacturing execution system (MES), and customer relationship management (CRM) systems is a major competitive advantage, they note. Not only does this visibility provide greater operational efficiencies; it also reduces production delays and enables alerts that can save days and weeks of lost time.

5. More manufacturing supply chains will go through a digitally-driven transformation aimed at prioritizing and optimizing their performance from the customer’s perspective. One of the major benefits of orchestrating analytics, BI, mobile ERP, and supplier quality management applications toward customer-centric goals is the ability to gain greater speed and scale in fulfilling orders. The path to growth for many manufacturers starts by being able to offer short-notice production runs. By digitally transforming supply chains, manufacturers will be able to have greater inventory and parts availability to the assembly, component and parts level. Achieving greater supplier collaboration by orchestrating these four technologies together is improving customer responsiveness today and will accelerate in 2019.

6. Rapid price reductions on smart machines will enable manufacturers to digitally transform legacy processes and pursue new digital models that weren’t in reach before. For many smaller and mid-tier manufacturers, 2019 will be the year they can afford smart production machines to help replace time-consuming legacy processes that stood in the way of pursuing new digital business models. With legacy production systems replaced by smart machines, quick-response business models that allow manufacturers to scale their product lines and add new ones will be in reach.

7. Manufacturers looking to escape costly price wars and premature commoditization of their products will fast-track smart, connected products. It’s not just industrial manufacturers facing price wars and commoditized product pressures. Manufacturers across several markets are dropping prices in the hopes of finding more sales, but this drains margin dollars. Forward-thinking manufacturers are shifting their product strategies to smart, connected products now, and those adopting IoT into their product strategies predict that in two years, 67 percent of their entire product portfolios will be smart, connected products. The cumulative revenue growth rate for manufacturing from smart, connected products is projected to grow by 16.22 percent from 2017 to 2022 according to Capgemini’s report, Digital Engineering: The new growth engine for discrete manufacturers.

8. With the proliferation of IoT endpoints across supply chains and production centers, the manufacturing industry realizes every identity is a new security perimeter. For many manufacturers, the integration of information technologies (IT) and operational technologies (OT) is the highest priority with little afterthought given to security. The challenge in 2019 will be protecting every threat surface and endpoint across the proliferating series of IoT-enabled supply chains and production networks. The manufacturing industry is going to experience several breaches in 2019, and it will take one that shuts down a production line to make the concept of Zero Trust Security (ZTS) a reality. ZTS begins with Next-Gen Access (NGA) that verifies every access attempt to every resource on a network along with machine learning to assign risk scores to every login attempt.

9. Industrial IoT (IIoT) platform pilots will target inconsistent, incomplete data structures at the machine, line, factory, and company IT levels with the goal of increasing productivity. Look for IIoT platform providers to offer pilots at little to no cost, so they have a chance to prove they can solve one of manufacturing’s greatest challenges: inconsistent, inflexible legacy data structures from the shop floor to the top floor. IIoT’s potential is in normalizing data across each level of production and attaining 360-degree process transparency. For IIoT to prove it has the security and scale to support daily production, it will need to solve the massive data structures issues that are slowing manufacturers’ growth.

10. IoT early adopters in manufacturing will be five times as likely to generate revenue from their IoT initiatives compared to peers. In 2019, there will be a widening gap between those manufacturers generating revenue from their IoT projects—including smart, connected products—and those that don’t. Look for IoT early adopters to dominate their industries on the ingenuity, scale, and pace of new product development, especially in the area of smart, connected products that rely on IoT sensors to communicate data. For manufacturers who focus on IoT as a growth strategy, 2019 will be a breakaway year compared to many of their peers who are still looking at IoT only for cost reduction.

Louis Columbus is currently serving as Principal of IQMS.