Charles Maniace

Charles Maniace A series of United States Supreme Court rulings over the past half-century limited manufacturers’ sales tax compliance obligations. The Court consistently dictated that states could not require businesses to collect and remit sales tax unless they had physical presences there—in other words, property owned or people based within state borders.

But all this has changed as technology continues to transform and revolutionize industries, including multi-channel manufacturing. Over the past three decades, e-commerce exploded, as the internet became a common household tool across the globe. Traditional brick-and-mortar retailers have been forced to adapt to new practices or die. Meanwhile, e-commerce-centric businesses and direct-to-consumer manufacturers have thrived amid this new globally-connected economic climate, without the burden of state regulatory constraints related to sales tax compliance.

Now, states are getting in on the action and looking for their share of the revenue. The Supreme Court this past June ruled in favor of a controversial South Dakota law that sought to require sales tax collection and payment from businesses that made 200 sales or generated $100,000 of revenue from sales to South Dakota residents. The case, referred to as South Dakota v. Wayfair, effectively overturned the existing Quill doctrine that had established the previous definition of nexus in 1992 prior to the boom of the ecommerce industry.

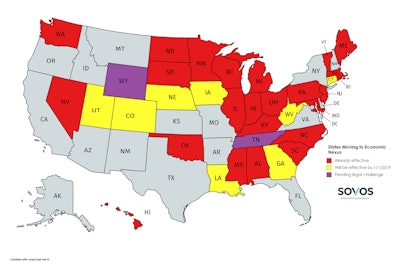

South Dakota’s own courts had previously rejected as unconstitutional this attempt at passing remote sales tax legislation. However, once the state brought the matter to the Supreme Court, the justices agreed—by a 5-to-4 margin—to modernize the standards that constitute nexus, reshaping the sales tax landscape in the United States. The Supreme Court did note that in this new regulatory environment, states would not be permitted to impose an “undue burden” on remote sellers. What does and does not constitute an undue burden remains unclear. The Court seemed to indicate that for South Dakota, the 200 transactions/$100,000 revenue standard was not unduly burdensome, and other states have moved (in droves) to enact similar rules. Already, more than 30 states have introduced new rules to impose sales tax on remote sellers. In many states, those rules are already in effect. For six of these states, the rules become effective with the New Year.

How Can Manufacturers Prepare for These New Tax Obligations?

While each state is free to apply its own nexus standard, many have enacted new rules that are identical to the one enacted in South Dakota or substantially similar. In theory, standardization should make it easier for manufacturers to understand where they may have a new collection obligation, but states do not all see eye-to-eye on how to count revenue and sales, complicating the matter.

For example, common variances between states include whether they consider each line on an invoice with multiple lines as an individual transaction or not. And some states factor exempt sales into threshold calculations, while others do not. So, what’s the best approach for manufacturers to determine where they may now be liable to collect and remit tax?

The best way to get started is by evaluating the states that account for most of your sales and revenue. Do these states have new collection requirements? Are the new thresholds different from South Dakota’s standards? Do your sales and revenue surpass these thresholds?

Once you understand your new sales tax footprint, the time for action is at hand. You need to register to collect tax in any state where you now have sales tax nexus, collect tax on your taxable sales (this is especially important for multichannel manufactures who sell both in the wholesale and retail space), and remit the correct tax on the proper sales tax return and the right time.

Manufacturers also need to consider exemption certificate management. In all the states where you have nexus, you are also now on the hook (if audited) to prove you received and accepted (in good faith) the appropriate exemption certificate. If you manually manage certificates today, think about whether your process will be able to withstand the expanded requirements of collecting certificates in additional states, and still keep you safe from audit assessments and penalties.

Vendor invoice validation can also be a critical step. Almost every state has at least some exemption related to manufacturing activities, but of course, no two states take exactly the same approach. For example, while some apply an exemption or reduced rate to sales of equipment to be used in any manufacturing facility, some limit the exemption to sales of equipment to be used in new facilities. That’s just the tip of the iceberg of complexity, as states vary widely on what constitutes manufacturing (e.g., is R&D or packaging included), how completely the item must be used in manufacturing to qualify (100 percent, 75 percent, 50 percent, etc.), among a host of other factors.

In a post-Wayfair world, all sorts of new sellers will be charging tax in all sorts of new states. Because of all these subtle and nuanced exemptions, global manufacturers should be particularly concerned about whether their suppliers will be charging them the right tax. If you have a process in place today to check vendor invoices—great. However, take a moment to review whether that process is sufficiently rigorous post-Wayfair. If you don’t have a process, the time is now.

How Can Manufacturers Avoid Tax Audits and Penalties?

The premise of South Dakota v. Wayfair is a simple one: In a digitized world with a digitized economy, technology is the answer—both for governments and for businesses. The Supreme Court noted that tax compliance software is available for any organization that will be affected by these new rules. In fact, if it were not for the availability of manageable and affordable compliance solutions, one could see the Court deciding the other way.

Tax automation software and centralized compliance efforts give manufacturers the ability to accurately and easily fulfill their obligations, while improving their efficiencies and removing the burden of compliance from tax and IT teams. In an increasingly digitized world, the answer to increasingly complex sales tax challenges is clear: Turn to technology.

Charles Maniace is the director of regulatory analysis at Sovos.