Imran Mia

Imran Mia The demands of the world economy have made manufacturing more complex and competitive than ever. For manufacturers, surviving and thriving in the new era of globalization is no simple matter, but rather one that requires managing sprawling supply chains while maintaining the bottom line.

To help keep costs low and operations running smoothly, manufacturers have been relying on lease arrangements to access much-needed assets, including industrial plants, heavy machinery, transportation equipment, and distribution centers. Until now, these leases have remained off-book in the footnotes of financial statements, but this will soon change with a wave of significant financial reporting regulations set to take effect.

In January 2019, new lease accounting regulations will “bring leases to balance sheet”, requiring manufacturers to add assets and liabilities that reflect the value and cost of nearly all leases, with the exception of low-value and short-term leases lasting less than 12 months. The new regulations, known as IFRS 16 and ASC 842, are the result of a long-awaited overhaul by the International Accounting Standards Board and Financial Accounting Standards Board, which aims to provide investors with a clearer picture of a company’s leasing obligations. For companies, however, the new rules could expose billions of dollars in leasing debt, and will require a significant amount of effort to ensure the demands of compliance are met without penalty.

While creating an articulate and responsive lease accounting model has long been critical for manufacturers, the new reporting requirements will now add a new layer of complexity, in particular in the following ways:

- Manufacturers often outsource the production of highly customized components, such as specific vehicle, technological, or construction parts, which require dedicated facilities or production lines. As manufacturers will typically exert control over the type, timing and quantity of production in these circumstances, they could be considered as having right of use for these facilities under the new rules. Companies should carefully analyse supply arrangements to determine whether a contract is or contains a lease.

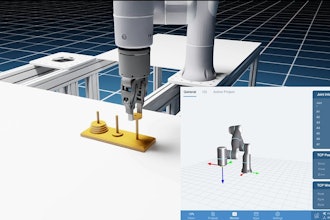

- As the industry continues to evolve to incorporate IoT, automation, and other new technologies, manufacturing equipment can quickly become obsolete. Companies vying to remain competitive may need to exit lease agreements to accommodate technological advances and shifts in operational strategy. Under the new accounting rules, companies will need to carefully consider any changes to their contracts, as they may result in a re-evaluation of the right-of-use asset, and will impact its accounting treatment.

- By now, manufacturers have likely become familiar with the financial implications of sale-leaseback transactions and build-to-suit contracts. However, the new lease accounting rules will not only require manufacturers to change their back-office processes, but decision-makers will also need to adapt their expectations on how these transactions affect financial statements.

Under the new standards, manufacturing companies will require access to accurate and real-time leasing data to identify the values, payments, and depreciation of leases, and to produce the required disclosure reports. However, the complexity and scale of the calculations required means that achieving compliance can be difficult without specialized software. The corporate accounting team can diligently manage the challenges and meet compliance deadlines by adopting lease management and accounting technology that centralizes data and automates accounting. Lease administration technology can help to streamline the compliance process by collecting and classifying leasing data, calculating liabilities and right-of-use assets, and compiling the required reports, while eliminating the errors that stem from sifting through spreadsheets with duplicated or missing information.

For manufacturers, the implementation of IFRS 16 and ASC 842 comes amidst an industry shift towards data-driven analytics and automation. Manufacturing companies have already found that adopting real-time, automated data collection on the factory floor can drive better decision-making and improved operational performance. Effective lease management is no exception. Moving forward, organizations who establish a lease administration ecosystem will be able to look to leasing data for valuable insights that can help cut costs and streamline supply chains.

Early adopters are already leveraging a centralized lease database to identify long-forgotten leases, shed liabilities, and consolidate lease terms for more favorable contracts. As manufacturers place an increasing premium on comprehensive data and clear decision-making, a transition to the new standards is simply part-and-parcel of manufacturing’s broader evolution into Industry 4.0. Simply put, compliance today could be key in the industry of tomorrow.

Imran Mia is an expert in lease accounting standards for Nakisa.