In a resource-constrained world, there is a noticeable trend of companies opting into the circular economy model. For manufacturers, this shift involves a move away from the “take-make-dispose” linear economy and a step towards increased responsibility over the total lifecycle of a product and its environmental impact. But to close the loop, manufacturers need to embrace change and learn to adapt their processes and products.

Circular economy, set to be the biggest revolution in the global economy in 250 years according to Accenture, is part of the ongoing narrative on industrial sustainability. Recent economic factors such as input cost rises and resource volatility have heavily influenced this shift towards a circular approach, but not all the reasons are reactive.

With a circular business model, manufacturing companies can achieve stronger value chain relationships and yield long tail revenues. But to reap the rewards, this shift requires change. As more companies opt into the circular economy and product lifecycles increase, manufacturers will not only need to re-examine and re-configure their operations, but also explore how they adapt their ERP solutions to meet the new demands required by these sustainable models.

In particular, there are four key areas where the impact of the circular economy in manufacturing is clear to see.

1. The creation of ‘like new’ products with reverse logistics.

As more companies strive towards resource-efficient manufacturing, overlooked processes such as remanufacturing are gaining traction. Unlike reconditioning, this technique returns a part or component to its original specification and allows companies to sell them at the quality and performance of a new resource—but that’s not all.

Industries that rely heavily on the process, such as automotive and electronics have seen the economic and environmental benefits firsthand. For instance, companies such as Eaton have made the decision to expand their remanufacturing program as they realize its potential to reduce the environmental impact of new production.

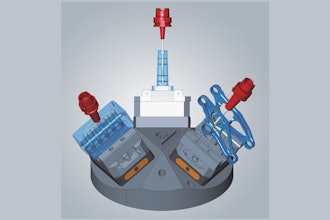

But to operationalize the circular economy, remanufacturing requires a consideration of several situation-dependent repair and refit processes. Manufacturers can receive units back in various quantities and this can create fresh difficulty in receiving, triaging and remanufacturing at scale.

For instance, dependent on the unit’s condition, units can be released for a standard remanufacturing process or may require a triage before being sent to a repair desk. Matters become further complicated when it comes to returning units as some customers require exact units back, while other products may be covered by warranty or a service contract. At each stage, it is crucial that the manufacturer ensures the agreement terms are met.

2. But a scale up requires a circular overhaul.

When it comes to the lifecycle extension of larger, higher-value assets such as heavy manufacturing equipment, some users, rather than buy in new, seek the assistance of original manufacturers to overhaul and rebuild their assets. Due to the size, complexity and project-centric nature of overhauls and lifecycle extensions, larger assets require additional considerations.

Unlike in the case of repairing and remanufacturing individual components, larger assets can be rejuvenated and upgraded with new electronics or even substantially reconfigured to deliver entirely new products. These aftermarket services allow companies that own and operate the assets to retain much of the value added to the raw materials.

Rebuilding and overhauling these larger assets is not only more environmentally responsible than recycling, but they also provide an opportunity for the OEM to add new, greener technology to remanufactured equipment. For example, Volvo Construction Equipment is using telematics-based services to boost existing machine productivity while simultaneously lowering a machine's carbon footprint.

3. Sustainable packaging is part and parcel.

The move towards circular product value chains is still in its infancy stage but considerable progress has already been made. For instance, dedicated organizations such as Loop are being set up to introduce re-usable packaging to popular brands. According to a Reusable Packaging Association study, this trend is being replicated in transport packaging—with 85 percent of users, manufacturers and service providers expecting to see increased demand for reusable packaging in the next 12 months.

As more governments introduce packaging regulation, the importance of circular economy is being recognized worldwide. In 2019, the Canadian government passed the initial phase of a Strategy on Zero Plastic Waste, which seeks to keep plastics in the economy instead of being disposed of in the environment. Governments are also putting in place regulations to cement the future of circular economy.

For example, McKinsey reports that 16 U.S. states have already enacted statewide regulations around packaging waste to target single-use plastics, shopping bags, and increasing recycling targets. Several more bills are pending to be approved over the next 3 years.

4. Avoid going round in circles - it all comes back to ERP.

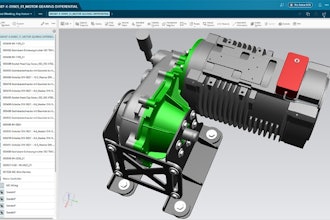

The previous strategy of using manufacturing software to simply add value to raw materials and help companies sell them at a profit is clearly no longer sufficient to support a circular economy model. Instead, ERP software needs to evolve to help manufacturers manage the entire lifecycle of their products—from maintaining, reconditioning, recycling and supporting the product over an extended lifecycle.

For instance, the software can incorporate environmental footprint management tools to capture the environmental footprint of the product over its lifecycle and present information for decision support. This information can include the percentage of post-consumer waste used in a product and will help manufacturers see where they can implement more sustainable practices.

Enterprise software must also provide visibility into the total product lifecycle cost and revenue profile—from new product development to cost of the sale, through to product replacement. In many cases, contract or warranty management software functionality will be essential in ERP software so a manufacturer can ensure they are invoicing appropriately for repairs or refurbishment and respecting warranties and maintenance agreements in place with each customer.

New packaging traceability can also be supported with the right ERP software. For instance, the software can use geolocation or bar code scanning to help manufacturers account for and track ownership of assets. Regardless of whether a manufacturer deals with packaging that is returned to be used again or products or components to be refitted, reverse logistics is probably the single most significant functionality to facilitate circular economy model.

As the pathway material takes in returning to the manufacturer varies, and can change over time, ERP software will also need to evolve to support reverse logistics associated with the new return considerations. These can range from managing the various methods of recognizing returning inventory to keeping track of material returning from field service reverse logistics channels.

As more companies opt into a circular economy, it is clear to see how the new approach can benefit the manufacturing sector.

Colin Elkins is the Vice President of Manufacturing Industries at IFS.