GENEVA (AP) -- The United States has challenged China to justify the legality of its tax, subsidy and export rules for farm products such as pork and wheat in what could signify new tensions between the two trading giants.

Most commercial disputes between Washington and Beijing have focused on manufacturing and services, but an American letter posted Tuesday on the World Trade Organization's Web site lists some new gripes over Chinese agricultural policies.

The document is dated Aug. 13, two weeks after the U.S. clashed with emerging powers led by China and India over farm import rules, leading to the collapse of nine days of talks on a new global trade deal.

The U.S. questions take aim at an article of China's business law which "wholly exempts agricultural producers from the payment of enterprise income taxes with regard to the 'rearing of livestock,' including pork." The U.S. argues that the loophole also exempts processors of pork from the tax, and has asked the Chinese government how much revenue its pork producers and processors are generating each year.

China will have a chance to respond at a WTO meeting Sept. 17-18, when the Asian country's next "transitional review" will be taken up.

Beijing agreed to a series of such reviews when it joined the global commerce body in 2001. While the meetings are informal, they often highlight points of contention between China and other trading powers. For example, the U.S. and the European Union have used the reviews to raise issues such as China's alleged industrial subsidies and discrimination against foreign news providers -- which later became formal complaints.

On pork, the United States also asked about a Chinese subsidy of 100 renminbi ($14.63) for every sow, double what it said was the previous rate. The U.S. cited an old Chinese government valuation of $886 million for the subsidy, but asked for new figures and clearer details of the program.

Washington also suggested China was handing out $2.2 billion annually in premiums under an insurance program for Chinese pork producers, as well as other payments linked to the size of large-scale pork breeding farms and for covering weather-related losses, slaughtering hogs and breeding sows.

While agricultural subsidies are allowed under WTO rules, they must comply with a set of rules specific for each country. The payments can be challenged if they fail to meet these guidelines and are found to unfairly harm competitor industries in other countries.

The U.S. also repeated its reservations about an issue it raised last year concerning China's 13 percent value-added tax for agricultural products.

Washington asked for clarification on loopholes because "it appears that sales of agricultural commodities produced and sold by farmers in China, such as wheat, cotton and corn, are exempted from the VAT." It added that sales of farm inputs such as seed, pesticide, herbicide, fertilizers and machinery also appeared exempt from the tax.

This could be discriminatory, the U.S. noted, because "when these same products are imported, it appears that they are assessed the VAT at the rate of 13 percent."

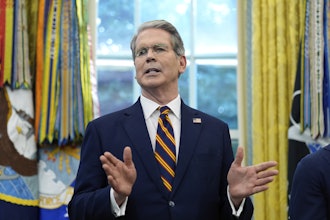

China's trade boom has caused friction with Europe and the United States as their trade deficits with the Asian country have grown. Democratic critics of trade policies under the administration of U.S. President George W. Bush charge the imbalance with contributing to millions of lost American manufacturing jobs.

Since the Democratic Party takeover of the U.S. Congress in 2007, the Bush administration has initiated cases against China over product piracy and restrictions on the sale of American books, CDs and DVDs. Another dispute over Chinese government subsidies in manufacturing was settled out of court, while the WTO in July ruled in favor of a complaint by the U.S., EU and Canada over Chinese auto parts rules.