NASHVILLE, Tenn. – According to a study by BBK, an international business advisory firm, 22 percent of the largest global automotive suppliers are in danger of having serious financial problems within the next 12 months.

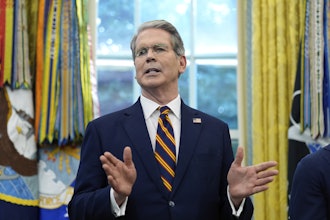

“It is absolutely critical for OEMs and Tier 1 suppliers to take a comprehensive proactive approach to carefully monitor both the operational and financial health of their suppliers," said BBK CEO William G. Diehl, in a speech at the Automotive News Manufacturing Conference in Nashville on Thursday. "If these companies are not proactively monitoring the health of their suppliers, they risk suffering a significant and costly disruption to their supply chain."

The study was conducted on 80 of the top 150 global automotive suppliers, based on 2006 revenues, using its proprietary BBK Ratings model, a tool that is used to evaluate both public company and private company financial data to determine the overall financial strength of a company.

The Ratings model assigns a grade from "A" to "F" depending on the potential for distress over the next 12 months. A company is considered distressed if it earns a "C," "D" or "F" rating.

The study found that about 33 percent of North American suppliers were at various levels of financial distress, including 11 companies that received an "F" rating.

The healthiest suppliers were Asian, with no companies in distress, while 14 percent of European suppliers were distressed.

Since the first Ratings study for fiscal year 2002, the number of "A" and "F" ratings have increased, indicating that there is little "middle ground" in the industry - suppliers are either healthy or severely distressed.

"Over the next few years, consolidation of the supply base will allow suppliers to leverage economies of scale and drive costs down," said Diehl. "The suppliers who find the right balance between outsourcing to lower-cost countries and looking for cost-effective ways to improve efficiency will be well poised for a healthy and sustainable future."

Click here for more information on the report.