Why Should Companies Consider Producing and Sourcing More Products Here in the U.S.?

It just makes good sense to produce and source products and components in the market in which they are going to be consumed. Localization, producing near the consumer, often reduces total cost due to shortening supply chains and contributing to a lean and agile strategy. The savings on non-manufacturing costs as a result of producing in the market in which the products will be sold can often overcome a 15-20% manufacturing cost gap.

Localization, an approach that is used by large firms such as Caterpillar, is driving companies to reevaluate offshoring. U.S. manufacturing is becoming increasingly attractive to U.S. and foreign companies. Rapidly increasing emerging market wage rates, the U.S. shale gas boom, productivity gains, and recognition of the economic benefits of manufacturing closer to customers are reasons for shifting perspectives and for the growth of the reshoring trend.

W. Edwards Deming, author of “Out of the Crisis”, offered 14 key principles for management to follow for significantly improving the effectiveness of a business. The 4th key principle clarifies the economic logic of reshoring. He said, “End the practice of awarding business on the basis of price tag. Instead, minimize total cost.”

Companies are finding that shortening supply chains and having manufacturing closer to customers increases quality control, flexibility, and time to market while diminishing the costs and risks associated with offshore production.

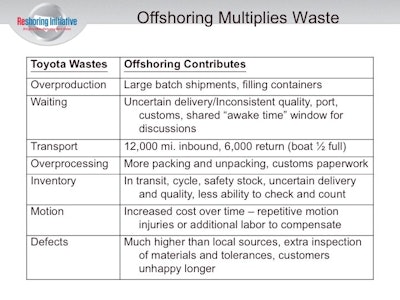

Reshoring lowers total cost by reducing waste. The table below shows how each of the wastes in the Toyota Production System is made worse by offshoring. Reshoring enables companies to develop more efficient processes.

When manufacturing is moved close to engineering, companies can: more easily improve design; eliminate waste; improve quality; and increase productivity. Often the result is a better product at a lower total cost.

This was the case when GE reshored manufacturing of the GeoSpring water heater from China to Kentucky. Design engineers, manufacturing engineers and factory line workers cooperated closely in one location to optimize the product. Material cost went down, the labor required to produce it went down and quality improved. Time-to-market also improved. This collaboration was so successful that they were able to sell the product for 20% less made in the U.S., even though GE U.S. labor costs/hour were about 5X higher than in China.

What are the Basics of Total Cost of Ownership (TCO)?

TCO is defined as the total of all relevant costs associated with making or sourcing a product domestically or offshore. TCO includes current period costs and best estimates of relevant future costs, risks and strategic impacts.

TCO analysis helps companies objectively quantify, forecast and minimize Total Cost. It takes into account: transportation costs; travel expense and time; warranty; IP loss; impact on product innovation; and many other factors such as those associated with the risk of supply chain shocks or disruptions caused by natural disasters and political unrest. It also helps to forecast the future impact of wage and currency changes.

How is Reshoring and Domestic Sourcing relevant to MRO?

In a few specialized cases MRO service has been offshored. Offshore labor rates have been rising (going up by 15-18 percent a year in China, 500 percent in the last 12 years). As a result, the labor cost savings may no longer be enough to offset the hidden costs associated with the safety consequences of increased foreign maintenance and less certain regulatory compliance.

According to ICF SH&E Vice President Kevin Michaels, quoted in an article in Aviation Week, “the trend of sending aircraft from the Americas to Asia for heavy maintenance will not stay forever and will reverse itself or reach a plateau by 2021, and the Southeastern United States will be a region to watch for viable MRO opportunities. Michaels went on to say, “In an era of high fuel costs, rising labor costs in China and more competitive labor costs in North America, we’re seeing that this migration of heavy maintenance to Asia will peak”. He explains that global changes are making it less economical for North American MROs to send aircraft to Asia for maintenance visits.

For in-house MRO management, reshoring and TCO offer several advantages:

- MRO material that is purchased directly from offshore will have significant TCO costs that need to be recognized.

- Imported MRO material that is purchased from local warehouses may have less dependable availability and quality than domestically sourced material.

- Domestically sourced capital equipment may have better service and spare parts support. At times, easy access to the factory’s equipment design engineers or assembly line personnel may be helpful in resolving complex service issues.

- Helping company management understand and utilize TCO for decisions about factory siting and the sourcing of direct material can improve company profitability and improve job security.

Sustainability

Through reshoring and domestic sourcing we can build strong local manufacturing companies and stronger thriving communities by keeping people in the community employed and providing tax revenue for local governments and schools. Manufacturing has the highest multiplier effect of any sector, so creating manufacturing jobs creates jobs in other sectors too.

There are also environmental and legal costs associated with offshoring. Companies may not be aware of offshore practices, which could involve: human rights issues; excessive pollution; counterfeit parts, creating unexpected and costly legal issues or public relations debacles. Offshoring has also been tied to health scares and product recalls including lead tainted children’s toys and toxic dog food.

Can TCO Help Multi-national Companies with Capital Investment Decisions?

Mixing TCO and ROI.

Multi-national companies are often faced with a decision of where to make capital investments. For the last 10 or 20 years the tendency has been to invest more in the low labor cost countries (LLC) and less in the U.S. or outsource to those countries and not invest at all. This trend was driven by the LLC’s low wage cost and high economic growth rates, which motivated increased interest in the LLC countries’ markets.

Much of the high growth rates were driven by increasing exports to the U.S. and other developed countries. A portion of the wage rate gap is gone. So, the decision on where to locate the incremental capacity is now more difficult. Sometimes companies have to decide whether to invest in-house here or to outsource to a LLC contract manufacturer offshore. If the company finds a 30% difference between in-house manufacturing cost and offshore purchase price, it is almost impossible to make a positive ROI on investment in automation, training and lean here to overcome the labor cost difference. However, if the company measures with TCO and finds only a 5 or 10% difference, the investment ROI just went up dramatically, sometimes making in-house the most profitable choice.

Investments in new equipment, equipment maintenance and automation play an important role in enabling reshoring of U.S. manufacturing and jobs.

A Total Cost of Ownership-based investment decision should be considered in equipment procurement and supplier selection. A TCO-based investment decision will take into consideration the hidden costs such as high freight costs, minimizing supply chain disruptions, flexibility to respond to maintenance needs and overall equipment effectiveness. Many times, reshoring investment in U.S.-based sourcing of capital equipment makes good economic sense.