This article originally appeared in the August print issue of IMPO Magazine. To view the digital version, click here.

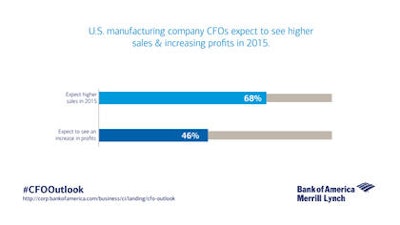

As more U.S. manufacturers look to expand overseas – whether through joint ventures or M&A activity – it is vital for them to consider ways to boost operational efficiencies. According to the Bank of America Merrill Lynch 2015 CFO Outlook, 88 percent of U.S. manufacturers report having an operational risk management program in place. But of those that do not have a program in place, just 31 percent believe it is a high priority to establish one, according to the survey. Further, companies that are expanding quickly need to evaluate and update their risk management processes — especially those that will have more exposure overseas.

Below are the most important considerations to manage operational risk for the manufacturing sector and best practices to strengthen efficiencies:

• Cost control

Managing costs may be an obvious priority for businesses at any phase. But companies working overseas will find that managing costs in new markets becomes an operational imperative, particularly when facing increasing labor and transportation costs. As a result, it is vital for companies to review their expenses and have contingency plans in case costs start to spiral out of control.

First, look at labor costs. In some overseas markets, companies will have to raise wages to compete for the right candidates, so it is critical to find other ways to reduce costs. Consider taking a page from the books of other industries that are consolidating benefits after a merger or expansion — in particular, the healthcare industry. In a recent roundtable discussion facilitated by Bank of America Merrill Lynch, healthcare executives said that consolidating vendors and other partners that offer benefits to employees can increase transparency and help employees access information. Consolidating benefits may also help companies manage costs.

Transportation costs also fluctuate – sometimes greatly – which is why risk mitigation is so important for this area. Manufacturing companies have contended with transportation cost challenges for years, and many already have good strategies. But it is important to review these strategies and consider new ideas. For instance, as Supply Chain Quarterly outlines, one strategy being used is developing a lean inventory/transport hybrid model.

Under this idea, companies take transportation costs into account and move between a lean inventory strategy, which can result in significant transport costs for just-in-time delivery, and shipper consolidation, or reducing the number of shipments by consolidating the goods being transported.

• Overseas supplier networks

Even though finance professionals understand the complexity of doing business abroad, most organizations face a learning curve when they are on-site in other markets because there can be quirks unique to each market, from payment structures to FX requirements. As a result of these nuances, companies may be tempted to outsource these important back-office tasks to their suppliers. But resist that urge, as doing so could increase costs in the long-run and lead to a loss of control over business activities.

Instead, companies should maintain control over these functions, in particular FX management and vendor payment. When it comes to FX management, it is important to devise a comprehensive system that outlines policies for converting currency across a market. As a first step, that means figuring out when in the cycle to convert the currency and in what currency to pay suppliers. U.S.-based companies often fall back on paying in U.S. dollars, but that may not be the best idea because it can constrict the FX strategy. Instead, look into consolidating the FX strategy and paying vendors or partners at a time each month that is most beneficial.

• Liquidity and cash flow

Manufacturing companies must also ensure that they can manage liquidity and cash flow after overseas operations are up and running. In general, the best practice for a global liquidity management strategy enables cash to be repatriated to a regional hub or to the central treasury. Doing so will allow finance leaders to see their cash position in real time. This is particularly important for manufacturers, who tend to work with numerous suppliers or distributors and therefore monitor cash flows regularly.

New technologies are enabling companies across the board to take control of their liquidity and cash flow operations. First, use technology to track cash positions. By using a SWIFT connection, for instance, treasurers can provide the required information on the cash position. Other technologies are available to collate account balances held by all of the banks across regions.

Also, manufacturers are using automated reporting processes, which can increase efficiency, transparency, accuracy and uniformity, to provide more up-to-date business information. Investment of cash is a major part of cash management, and that is where global policies are an important risk-mitigation tool. For instance, many companies segment cash into tiers (such as reserves, operational cash or strategic), which allows them to benefit from higher yields in one account. When companies have a full understanding of their cash positions, they can institute these global investment policies.

But understanding cash positions and having a global investment strategy are only half of the equation for cash-flow management overseas. Companies with foreign market activities must allow for flexibility in delivering on these policies. Similar to payment structures and FX requirements, countries have different requirements when it comes to investing and moving around cash. Companies doing business globally must stay up-to-date on the liberalizing of the banking rules while also determining the best ways to achieve visibility into banking accounts and maximizing returns on cash.

In other cases, local tax requirements can be cumbersome-- the way that withholding tax, transfer pricing, value-added tax and capitalization rules are applied varies among countries. Treasurers of global organizations must be sure that their policies allow for necessary adaptations, while still following the spirit of the business policies and providing needed transparency.

• Going forward

According to the 2015 Outlook, four out of five manufacturers already do business in a foreign market or expect to do so. The renewed energy around U.S.-based manufacturing is leading many companies to explore ways to grow their businesses overseas. But to ensure they are maximizing their expansion strategies, they must also focus on the operational risks of working in overseas markets.